Excellent Suggestions On Deciding On An AI Agent Website For Business

Wiki Article

10 Ways Companies Can Make Use Of Ai Agents To Automate The Invoice Processing Process Of Financial Operations.

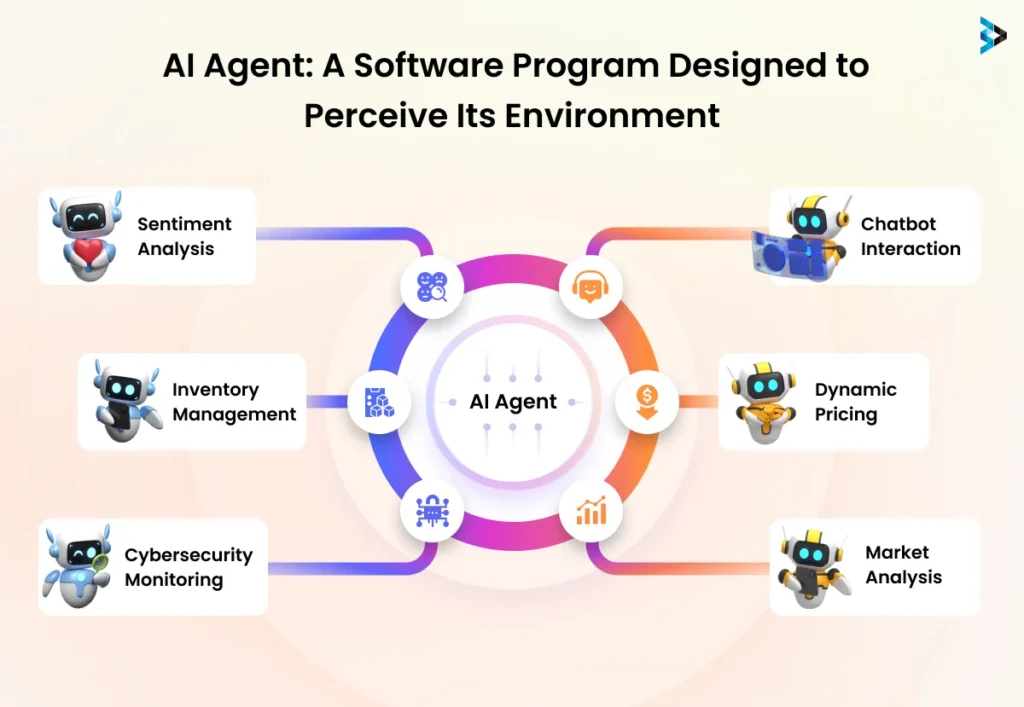

AI agents are utilized in a variety of ways to automatize invoices and financial processes.

1. Automated Data Extraction

AI agents glean important information from invoices, such as:

Name of the vendor as well as the date of invoice and amount.

Line items, tax information and payment terms made using Optical Character Recognition (OCR) and Natural Language Processing (NLP).

2. Intelligent Invoice Matching

AI validates invoices by:

You can associate them with purchase orders, contracts or delivery receipts.

Finding discrepancies, and indicating them for further investigation.

3. Real-Time Invoice Validation

AI provides accuracy by:

Review the invoices attentively for any errors.

Validating compliance to business rules and tax regulations.

4. Processes for Approval that are streamlined

AI automatizes approval processes through:

The routing of invoices to be approved is based on rules predefined.

Reduce the time it takes to complete your project by delivering automated reminders to approvers.

5. Automated Payment Scheduling

AI schedules payments by:

To get the early-payment discount It is essential to analyze the dates of due to maximize the timing of payment.

By making sure that your payments are timely to stay clear of late payment penalties.

6. Fraud Detection & Prevention

AI improves security in:

Recognizing unusual patterns, like high prices or unfamiliar suppliers.

Flagging fraudulent invoices and requesting an investigation.

7. Integrating Accounting Systems

AI syncs data by:

Make changes to financial systems, like ERP software and accounting software, in real-time using invoices that have been processed.

Eliminating the need to manually enter data, and enhancing accuracy across the systems.

8. Intelligent Cost Allocation

AI categorizes expenses by:

Allocating invoice amounts to appropriate cost centers or project codes.

Conformity with internal budgeting guidelines.

9. Real-Time Analytics & Reporting

AI provides insights from:

Providing dashboards with metrics like processing time, invoices that are not paid, and cash outflows.

Predictive analytics can be utilized to identify trends, improve decision making and better understand the market.

10. Reduced manual effort

AI can help minimize the need for human intervention

Automating repetitive processes such as the logging of invoices. Tracking approvals. and status updates.

Allowing employees more time to focus on financial strategic tasks.

AI agents help with invoice processing, decreasing errors, improving efficiency, and ensuring faster turnaround time. This results in better cash management and vendor relationships. Take a look at the best AI agent for Subscription Renewal Notifications for site examples including AI agent for procurement expense tracking, AI agent for customer management, AI agent for procurement expense tracking, AI agent for chargeback handling, AI agent for customer ticket management, AI agent for contract compliance, AI agent for refund validation, AI agent for procurement expense tracking, AI agent for threat intelligence gathering, AI agent for customer issue resolution and more.

Ai Agents: Predictive Analytics For Cash Flow Management Is A Powerful Tool That Companies Can Utilize.

There are a variety of ways businesses can make use of AI agents for managing cash flows and financial transactions.

1. Forecasting Revenue Streams

AI predicts the flow of cash into the coming days through:

Analyzing historical trends in the patterns of customer payments, revenue and sales data.

The ability to identify seasonal patterns and forecast the future revenue streams.

2. Predicting the time delay of a payment

AI forecasts cash-flow disruptions by:

Monitor payment behavior and history of customers.

High-risk accounts that have a high chance of late payment or default.

3. Optimizing Expense Management

AI anticipates cash flow incoming by:

Analyzing regular expenses, vendor payments and operating costs.

Highlighting the opportunities to reduce costs or optimize.

4. Scenario Based Cash Simulations of Flow

AI assists decision-making by:

Think about "what would happen" scenarios that may involve modifications to sales volume, pricing or payment terms.

Aiding businesses to plan the best-case scenario scenarios, worst-case scenarios, and most likely cash-flow outcomes.

5. Real-time monitoring of cash position

AI provides real-time insights by:

The aggregation of bank account data ledgers, invoices, and other accounts.

Live cash flow data is available to help you immediately take actions.

6. Dynamic Budget Allocation

AI assists in allocating funds effectively.

Predicting cash flow needs for the short and long term.

Recommending budget adjustments to maximize the use of resources.

7. Proactive Debt Management

AI supports debt management by:

The ability to predict loan repayment dates and interest impacts on cash flow.

It is crucial to be aware of when the ideal time is to pay or secure financing.

8. Identification of Liquidity Gaps

AI warns businesses of possible shortfalls.

The projection of future cash flows, as well as outflows can be a useful method of identifying periods when there is a deficit.

Giving suggestions for bridging gaps, like securing short-term funding.

9. Improvement of the Customer Credit Management

AI increases cash flow reliability through:

Examining creditworthiness and altering the terms of payment.

Lower the risk of having bad credit, cash flow interruptions and other financial difficulties.

10. Advanced Reporting and Insights with Insights

AI offers actionable analytics through:

Develop precise cashflow forecasts and variance reports.

Highlighting important metrics such as days sales outstanding and cash conversion rates.

Businesses can enhance their cash flow management and lessen the risk of financial uncertainty, and make better decisions by leveraging AI and predictive analytics. See the best AI agent for Reconciliation for more recommendations including AI agent for contracts, AI agent for service level agreement monitoring, AI agent for refund processing, AI agent for payroll management, AI agent for code documentation, AI agent for legal, AI agent for invoice matching, AI agent for compliance assurance, AI agent for trAIning documentation, AI agent for account inactivity monitoring and more.

AI Agents can improve vendor and partner collaboration by a variety of ways.

The 10 suggestions below will help you improve the relationship between partners and vendors within your financial operations using AI agents.

1. Automated Vendor Management

AI agents improve vendor relations by:

Automating the onboarding process for new vendors including contract management payments, payment terms, and checks for compliance.

Maintaining updated vendor profiles with renewal dates for contracts as well as performance metrics and payment histories, to ensure the smoothest and most proactive engagement.

2. Increased communication with Vendors

AI enhances communication:

Chatbots powered by AI and virtual assistants can be utilized to address routine vendor queries, like payment statuses or order tracking.

7.

Enabling seamless and consistent communication across multiple platforms, while ensuring that both parties are aligned and up-to-date at all times.

3. Terms and schedules for payments: Optimize them

AI helps manage vendor payments by:

Analyzing historical payment data and suggesting optimal schedules of payments that ensure a good relations with vendors, while improving cash flow management.

Provide recommendations for early payment discounts and dynamic payment terms, based on the vendor's performance.

4. Predictive Analytics for Order Management

AI can be used to help support the relationship between partners and vendors through:

With predictive analytics, you are able to reduce inventory and enhance order fulfillment by reducing costs.

Sharing these ideas with vendors, helping them improve their supply chain planning and anticipate needs.

5. Automated Invoice Reconciliation

AI simplifies the invoice process by:

Automating the process of matching vendor invoices to purchase receipts and purchase orders, ensuring fast and accurate payment processing.

Reduce the number of disputes and discrepancies that occur in payment, and build the trust and co-operation between businesses and their suppliers.

6. Monitoring of Risk and Compliance

AI helps monitor risks by:

Analyzing vendor financial stability and performance to identify any risks that could be present as soon as possible, including late deliveries or compliance violations.

By notifying relevant teams about the issues that arise, you can make sure that your vendors and partners are adhering to contractual conditions.

7. Data-Driven Contract Optimisation

AI aids in contract management through:

Analyzing past contract data allows you to discover patterns, trends and renegotiation opportunities, thereby increasing your business relationships with partners and suppliers.

Making proposals for clauses that are more fair and based on actual market conditions.

8. Transparent Financial Reporting

AI enhances transparency by:

Financial reports are available in real-time for vendors and business partners, which include payments and transaction history.

By ensuring each party is able to track financial transactions and cooperate in order to resolve problems and issues, you will build lasting relationships and build trust.

9. Collaboration in Budgeting and Forecasting

AI helps in coordinating Financial Planning through:

Collaboration with vendors and partners to better align resources and expectations.

Offering insights into the fluctuations in demand as well as production timelines and sales forecasts, which allows sellers to adapt their strategies to meet the changing needs.

10. Performance tracking and feedback

AI improves vendor performance management by:

Utilizing data to monitor KPIs like delivery times as well as quality assurance and cost-efficiency of each vendor or partners.

Provide automated, data driven feedback to the vendors. This will enable continuous improvement of services or products, and ensure the partnership brings mutual benefits.

Businesses can increase efficiency by integrating AI into their vendor and partners' collaboration. They can also strengthen relationships, decrease administrative burdens, as well as provide an open, collaborative and productive financial environment. This results in better negotiations, more efficient transactions, and more productive long-term partnerships. Check out the most popular AI agent for Procurement for website advice including AI agent for customer feedback collection, AI agent for vendor performance, AI agent for self-service portal management, AI agent for customer order processing, AI agent for interviewing, AI agent for ticket closure notifications, AI agent for vendor selection, AI agent for customer service, AI agent for account inactivity monitoring, AI agent for salary data validation and more.